These steps, alongside rising crypto ownership among Portuguese investors, make the market well-placed to benefit from crypto-enabled transactions.

Internationally, high-profile deals (e.g., a $22.5m Miami penthouse paid entirely in crypto) have shown that digital assets can settle large property purchases, accelerating mainstream acceptance.

Understanding crypto payments in real estate

A crypto real estate payment is a transfer of digital assets (e.g., BTC, ETH, or a stablecoin like USDC) from a buyer’s wallet to a seller or to a trusted payment processor that converts funds into fiat for the seller.

Platforms such as CoinsPaid provide an invoicing flow, accept 20+ cryptocurrencies, can auto-convert to 40+ fiat currencies, and offer an escrow-style sequence so the seller ultimately receives euros in their business wallet and then to their bank.

Stablecoins (e.g., USDC) are commonly used to minimize price swings; they’ve already been used in completed real estate transactions.

Portugal’s crypto engagement, in particular, is high: BlackRock’s People & Money survey finds 43% of Portuguese investors hold crypto (about double the EU’s average of 22%). That signals meaningful buyer demand for crypto-friendly options.

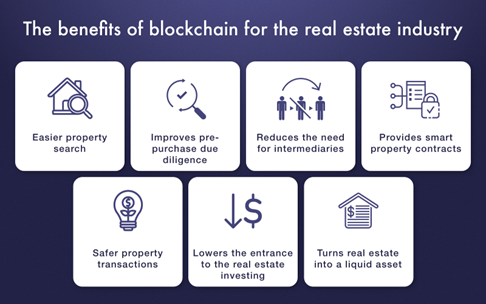

Benefits of crypto payments for real estate

Speed and efficiency

On-chain payments settle in minutes rather than the 2-5 business days typical for cross-border wires. CoinsPaid’s flow shows settlement within minutes and fees under ~1.5% depending on plan (important for high-value transactions where delays and costs compound).

Cross-border simplicity

Crypto is borderless. Buyers can pay in BTC/ETH/USDC while the seller receives euros through instant conversion – no intermediary banks, SWIFT hold-ups, or FX surprises. CoinsPaid supports 20+ cryptos and 40+ fiat currencies to streamline this.

Transparency and security

Blockchain records payments on an immutable ledger (useful for audit trails) and finalized crypto payments can’t be charged back, reducing reversal risk. CoinsPaid emphasizes a security-first posture: ISO/IEC 27001 certification, independent security audits, real-time risk scoring, and dedicated KYC/AML.

Access to new buyer segments (no prior crypto experience needed)

Crypto-native and globally mobile buyers (including younger investors and high-net-worth individuals) prefer paying directly in digital assets. Sellers don’t need to manage wallets or market risk: CoinsPaid can auto-convert crypto to euros and provide accounting documents.

Challenges and solutions

Volatility

Coin prices can move between signing and closing.

CoinsPaid offers “volatility protection” by locking the exchange rate at initiation so the seller gets the exact euro amount expected. Using stablecoins can further reduce exposure.

Regulatory environment

Portugal allows crypto property deals when compliance steps are followed.

EU-wide, the MiCA regime is now in application, bringing clearer standards for crypto service providers and licensing across member states. Working with a regulated processor helps align with AML/KYC and documentation needs.

Legal and tax implications

Purchase contracts should specify pricing, conversion method, and reporting.

Since 2023, Portugal taxes short-term crypto gains (held <365 days) at 28%, while long-held assets remain exempt; proper records matter.

CoinsPaid supplies transaction and accounting documentation to support audits and tax filings. Always seek local legal/tax counsel.

Infrastructure and adoption

Many agencies lack crypto expertise.

CoinsPaid’s business wallet, invoicing and payment-link tools, and support team reduce operational friction (no extra hardware or in-house crypto specialists required.

Security

Safeguards are essential in high-value payments.

CoinsPaid cites ISO 27001, third-party audits (e.g., Hacken, 100Guards), and precise risk scoring on each transaction.

How Crypto Payments Can Drive Industry Growth in Portugal

- Broaden the buyer funnel: With high local crypto participation and strong global interest in Portuguese property, accepting crypto invites international demand without FX or bank friction. Marketing listings as “crypto-friendly” can capture attention from crypto holders seeking real-world assets.

- Provide competitive payment flexibility: Sellers who offer both conventional and crypto rails can close faster and differentiate offerings, particularly in prime and new-build segments. CoinsPaid’s instant conversion to euros helps sellers keep standard fiat workflows.

- Reduce bottlenecks and accelerate closings: Faster settlement and fewer intermediaries shorten timelines between promissory contract and deed. Standardized documentation from processors simplifies back-office tasks and improves certainty of funds.

Case studies and real-world examples

● Live crypto-eligible listings in the Porto metro (summer 2025). CryptoRealEstate’s Portugal feed shows multiple properties added in June-July 2025 around Porto (e.g., Miramar/Canidelo, Vila Nova de Gaia) marketed for purchase with Bitcoin/crypto. Even without disclosed closings, the fresh inventory signals that agencies in northern Portugal are actively prepared to handle crypto bids.

● Operational playbooks under MiCA/AML (2025). Portuguese brokerages and advisors have started publishing practical, MiCA-aligned “how-to” guides for crypto-denominated purchases (covering KYC/AML steps, contract language, notary documentation, and reporting) reflecting routine deal support in Lisbon, Algarve, and Madeira. Royal Estates’ June 2025 guide is a representative example.

● Comporta tokenization goes public (H2 2025). Portuguese fintech Lympid announced a tokenized luxury development in Comporta, with fractional participation via crypto assets from the second half of 2025. The plan was reported by ECO and Idealista, indicating on-shore adoption of blockchain rails for primary residential projects.

● Notarial normalization + EU clarity (late 2024-2025). The Ordem dos Notários highlighted “cryptocurrency as a means of payment for the sale of a property” in late 2024, underscoring professional readiness to process such deals. In parallel, the EU’s MiCA regime entered application on 30 Dec 2024 (with Portugal’s central bank issuing guidance on authorisation), giving market participants clearer guardrails for crypto-linked conveyancing.

The future of real estate payments in Portugal

Regulatory clarity is set to keep nudging adoption forward. With MiCA fully applicable across the EU since 30 December 2024, national authorities have begun issuing crypto-asset service provider authorisations, which brings a more consistent rulebook and should make agencies and developers more comfortable offering a crypto payment option.

Execution will hinge on strong fintech partners. Providers like CoinsPaid make the day-to-day practical: they handle KYC/AML, lock exchange rates at payment to remove volatility risk, convert incoming BTC/ETH/USDC straight into euros, and deliver audit-friendly documentation – so, operationally, accepting crypto can feel as straightforward as a bank transfer for a real-estate business. ISO/IEC 27001 certification and independent security reviews further reduce perceived risk around high-value closings.

Finally, education and coordination will determine the pace. As notaries, lawyers, regulators and payment processors align on standard templates and checklists under MiCA/AML guidance, the process becomes easier to repeat and explain to clients. Practical “how-to” materials are already circulating in the Portuguese market, which (combined with a few recent wins) gives the ecosystem a credible base to scale.

Embracing change for sustainable growth

Crypto payments can help Portugal’s real estate sector grow by widening access to global buyers, speeding up settlement, and improving transparency – without forcing sellers to manage digital assets themselves.

The remaining hurdles (volatility, compliance, and process know-how) are manageable with the right partner. CoinsPaid’s volatility protection, instant fiat conversion, KYC/AML controls, ISO-certified security, and escrow-style flows are designed to make high-value property transactions faster, safer, and simpler.